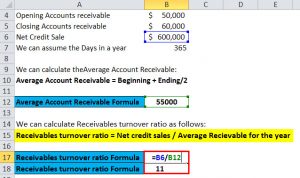

This is the number of times the business collects its average receivables in a year. The accounts receivable turnover ratio for business would be: Its accounts receivable balance was $47,000 at the beginning of the financial year and $39,000 at the end of the financial year. Returns and allowances for that year were $35,000. Let’s say a business has $650,000 in credit sales for the year.

#Accounts receivables turnover ratio formula how to

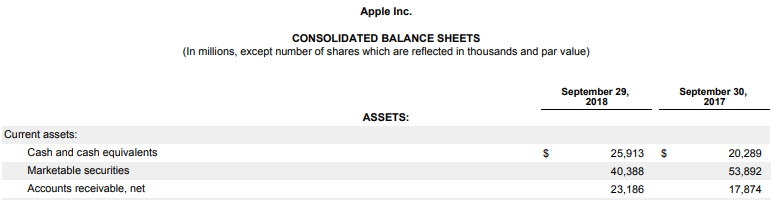

Now that we know how to calculate the accounts receivable turnover ratio, let’s consider a hypothetical example. In this case, you would use annual credit sales (minus return and allowances) to get the ratio for the one-year accounting period. If you want to know the accounts receivable ratio for the year, you add the accounts receivable balance at the beginning of the year to that at the end of the year and divide by 2. Net credit sales are those invoiced – not cash sales (less sales returns or allowances)Īverage accounts receivable is the sum of the beginning and ending accounts receivable divided by 2. Net sales on credit ÷ Average accounts receivable We use the accounts receivable turnover ratio equation as follows: This is an efficiency ratio that shows how many times over a given period a company collects its average accounts receivable. What is the accounts receivable turnover ratio? Knowing how to calculate and interpret the ratio will help you benchmark your receivables functions and take steps to improve them. It does not store any personal data.The accounts receivable turnover ratio is an accounting metric that shows how well a company collects its receivables from customers. The cookie is set by the GDPR Cookie Consent plugin and is used to store whether or not user has consented to the use of cookies. The cookie is used to store the user consent for the cookies in the category "Performance". This cookie is set by GDPR Cookie Consent plugin. The cookie is used to store the user consent for the cookies in the category "Other. The cookies is used to store the user consent for the cookies in the category "Necessary".

The cookie is set by GDPR cookie consent to record the user consent for the cookies in the category "Functional". The cookie is used to store the user consent for the cookies in the category "Analytics". These cookies ensure basic functionalities and security features of the website, anonymously. Necessary cookies are absolutely essential for the website to function properly.

The more efficient a company is at collecting its receivables, the more positive its cash flow situation, and the more capable it will be of meeting its financial obligations.Ī higher A/R turnover ratio also demonstrates that, since a business is more likely to collect on its debts in a timely manner, it makes a better candidate for borrowing funds.Įfficient operations and a quality credit rating are both desirable attributes of any company you may be considering as an investment. So what does the accounts receivable turnover ratio measure? If an organization’s AR turnover ratio is 4, as in the example of Company Z, it means it collects its average accounts receivable amount four times a year, or about every 90 days. This means that it’s better at converting its outstanding credit sales into cash more frequently throughout the year. The higher a firm’s AR turnover ratio is, the more efficient it is at collecting its customer receivables. so what does accounts receivable turnover mean? Okay now let's see how the accounts receivable turnover is used to analyze a company's efficiency.

0 kommentar(er)

0 kommentar(er)